IRS

Haven’t filed your 2019 business tax return yet? There may be ways to chip away at your bill

The extended federal income tax deadline is coming up fast. As you know, the IRS postponed until July 15 the payment and filing deadlines that otherwise would have fallen on or after April 1, 2020, and before July 15. Retroactive COVID-19 business relief The Coronavirus Aid, Relief and Economic Security (CARES) Act, which passed earlier…

Read MoreVirginia Governor Signs Tax Conformity Legislation

Virginia Governor Ralph Northam signed legislation today to conform Virginia’s tax laws to the Federal Tax Cuts and Job Act. The Virginia Department of Taxation can now begin processing 2018 individual income tax returns. Additional information can be found at www.tax.virginia.gov. Contact us today if you have questions about this or other tax legislation.

Read MoreVideo Series

WellsColeman kicks off Friday Feature video series on CPA Secrets to a Better Business. (Week 1) Friday Feature: This week’s theme is Acquiring Financing. Are you making the right decisions when it comes to seeking financing? Check out our latest video in the series to learn more. Acquiring Financing – Series Video #1 (Week 2)…

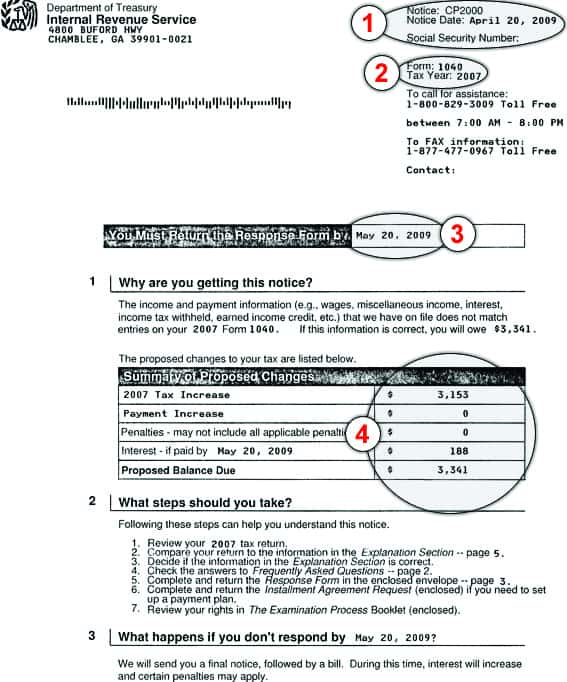

Read MoreIRS Warns about Fake Tax Notice Scam

IRS Warns Taxpayers and Practitioners of Fraudulent CP2000 Notices In a recent news release, the IRS alerted taxpayers and tax pracitioners to an email scam involving fraudulent CP2000 notices for the 2015 tax year. The notices, which are attached to the email and appear to be issued from an Austin, Texas address, relate to the…

Read MoreYear-End Tax Planning

Upcoming Changes to Filing Deadlines and New Overtime Provisions Beginning January 1, 2017, several new filing deadlines will go into effect. The IRS’s goal of these new deadlines is to create a more logical flow of information and help you file more accurate and timely returns. Avoid missing deadlines by making a note of the dates that…

Read MoreChanges Affecting Qualified Retirement Plans

Changes Affecting Qualified Retirement Plans With the Internal Revenue Service’s recent release of final regulations on Roth distributions, it might be a good time to summarize the several changes that have been made either through legislation, IRS action, or court decisions affecting qualified retirement plans over the last year or so. Designating Disbursements — In Notice…

Read MoreIRS Increases Interest Rates

IRS Raises Interest Rates for the First Time Since 2010 The Internal Revenue Service has raised interest rates for the calendar quarter beginning April 1, 2016, the first change to the interest rates since the fourth calendar quarter of 2010 when the federal short-term rate decreased from 1 percent to 0 percent. Revenue Ruling…

Read MoreReview of Tax Return Letter

Refunds May Be Delayed due to Extra Review The Virginia Department of Taxation is sending “Review of Tax Return” letters (AUIN073A RAP Additional Review) to some taxpayers to verify withholding information. This letter tells you that the Virginia Department of Taxation received an individual income tax return with your name and/or social security number and…

Read MoreTen Things to Know about Identity Theft & Your Taxes

Ten Things to Know about Identity Theft & Your Taxes Learning you are a victim of identity theft can be a stressful event. Identity theft is also a challenge to businesses, organizations and government agencies, including the IRS. Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return…

Read More