Business

5 ways to strengthen your business for the new year

The end of one year and the beginning of the next is a great opportunity for reflection and planning. You have 12 months to look back on and another 12 ahead to look forward to. Here are five ways to strengthen your business for the new year by doing a little of both: 1. Compare…

Read MoreSmall Businesses: It may not be too late to cut your 2019 taxes

Don’t let the holiday rush keep you from taking some important steps to reduce your 2019 tax liability. You still have time to execute a few strategies, including: Buying assets. Thinking about purchasing new or used heavy vehicles, heavy equipment, machinery or office equipment in the new year? Buy it and place it in service…

Read MoreHoliday parties and gifts can help show your appreciation and provide tax breaks

With Thanksgiving behind us, the holiday season is in full swing. At this time of year, your business may want to show its gratitude to employees and customers by giving them gifts or hosting holiday parties. It’s a good idea to understand the tax rules associated with these expenses. Are they tax deductible by your…

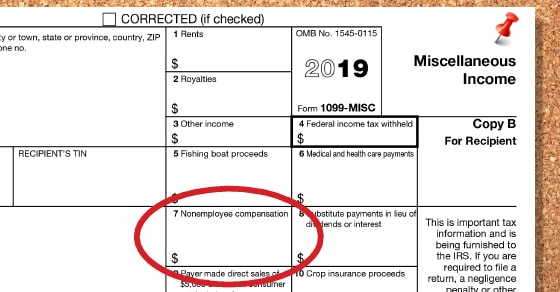

Read More2019 Business Reporting Reminders Guide

Now more than ever, it is imperative to make sure you meet the reporting obligations as detailed below for: Form 1099-MISC S-Corporation Health Insurance Personal Use of Employer-Provided Vehicle Personal Property Tax and Business License Returns Employer Payroll Update Form 1099-MISC There are several items to keep in mind that will streamline the process,…

Read More2019 Business Planning Guide

All businesses seek to reduce costs, and year-end tax planning presents the opportunity for significant savings that affect your bottom line. The Tax Cuts and Jobs Act of 2017 created a myriad of challenges for businesses of all types. But along with the challenges are opportunities for businesses to leverage timely tax strategies to lower their…

Read More2 valuable year-end tax-saving tools for your business

At this time of year, many business owners ask if there’s anything they can do to save tax for the year. Under current tax law, there are two valuable depreciation-related tax breaks that may help your business reduce its 2019 tax liability. To benefit from these deductions, you must buy eligible machinery, equipment, furniture or…

Read MoreBridging the gap between budgeting and risk management

At many companies, a wide gap exists between the budgeting process and risk management. Failing to consider major threats could leave you vulnerable to high-impact hits to your budget if one or more of these dangers materialize. Here are some common types of risks to research, assess and incorporate into adjustments to next year’s budget:…

Read MoreSmall businesses: Get ready for your 1099-MISC reporting requirements

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. You may have to send 1099-MISC forms to those whom you pay nonemployee compensation, as well as file copies with the IRS. This task can be time consuming and…

Read MoreSmall businesses: Stay clear of a severe payroll tax penalty

One of the most laborious tasks for small businesses is managing payroll. But it’s critical that you not only withhold the right amount of taxes from employees’ paychecks but also that you pay them over to the federal government on time. If you willfully fail to do so, you could personally be hit with the…

Read More