Business

5 ways to take action on accounts receivable

No matter the size or shape of a business, one really can’t overstate the importance of sound accounts receivable policies and procedures. Without a strong and steady inflow of cash, even the most wildly successful company will likely stumble and could even collapse. If your collections aren’t as efficient as you’d like, consider these five…

Read MoreWho in a small business can be hit with the “Trust Fund Recovery Penalty?”

There’s a harsh tax penalty that you could be at risk for paying personally if you own or manage a business with employees. It’s called the “Trust Fund Recovery Penalty” and it applies to the Social Security and income taxes required to be withheld by a business from its employees’ wages. Because taxes are considered…

Read More10 facts about the pass-through deduction for qualified business income

Are you eligible to take the deduction for qualified business income (QBI)? Here are 10 facts about this valuable tax break, referred to as the pass-through deduction, QBI deduction or Section 199A deduction. It’s available to owners of sole proprietorships, single member limited liability companies (LLCs), partnerships and S corporations. It may also be claimed…

Read MoreIRS extends administrative relief for 401(k) plans

As mitigation measures related to COVID-19 ease, it will be interesting to see which practices and regulatory changes taken in response to the pandemic remain in place long-term. One of them might be relief from a sometimes-inconvenient requirement related to the administration of 401(k) plans. A virtual solution In IRS Notice 2021-40, the IRS recently…

Read MoreEligible Businesses: Claim the Employee Retention Tax Credit

The Employee Retention Tax Credit (ERTC) is a valuable tax break that was extended and modified by the American Rescue Plan Act (ARPA), enacted in March of 2021. Here’s a rundown of the rules. Background Back in March of 2020, Congress originally enacted the ERTC in the CARES Act to encourage employers to hire and…

Read MoreTraveling for business again? What can you deduct?

As we continue to come out of the COVID-19 pandemic, you may be traveling again for business. Under tax law, there are a number of rules for deducting the cost of your out-of-town business travel within the United States. These rules apply if the business conducted out of town reasonably requires an overnight stay. Note…

Read MoreAre your company’s job descriptions pulling their weight?

At many businesses, job descriptions have it easy. They were “hired” (that is, written) many years ago. They haven’t had to change or do anything, really, besides get copied and pasted into a want ad occasionally. They’re not really good at what they do, but they’re used again and again because everyone assumes they’re just…

Read MoreDon’t assume your profitable company has strong cash flow

Most of us are taught from a young age never to assume anything. Why? Well, because when you assume, you make an … you probably know how the rest of the expression goes. A dangerous assumption that many business owners make is that, if their companies are profitable, their cash flow must also be strong.…

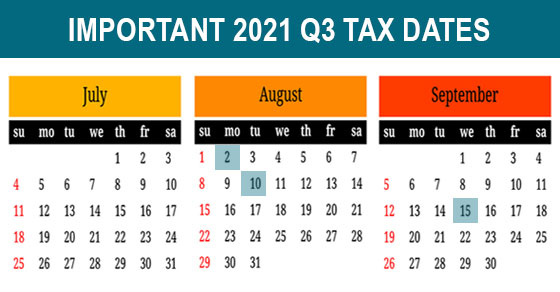

Read More2021 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Monday,…

Read More