Business

How should your marketing strategy change next year?

The current calendar year is winding down and a fresh 12 months lies ahead. That makes now a good time to think about how you should present yourself to customers and prospects next year. The U.S. economy has undergone notable change in 2022. Namely, rising inflation and persistent supply chain challenges have forced companies to really contemplate…

Read More2022 Business Planning Guide

With year-end approaching, it is time to consider moves that may help lower your business’s taxes for this year and next. This Guide outlines strategies that may help lower your tax bill. However, careful planning involves more than just focusing on lowering taxes for the current and future years. Each potential tax savings opportunity must…

Read MoreM&A on the way? Consider a QOE report

Whether you’re considering selling your business or acquiring another one, due diligence is a must. In many mergers and acquisitions (M&A), prospective buyers obtain a quality of earnings (QOE) report to evaluate the accuracy and sustainability of the seller’s reported earnings. Sometimes sellers get their own QOE reports to spot potential problems that might derail…

Read MoreWhat local transportation costs can your business deduct?

You and your small business are likely to incur a variety of local transportation costs each year. There are various tax implications for these expenses. First, what is “local transportation?” It refers to travel in which you aren’t away from your tax home (the city or general area in which your main place of business…

Read MoreWorried about an IRS audit? Prepare in advance

IRS audit rates are historically low, according to a recent Government Accountability Office (GAO) report , but that’s little consolation if your return is among those selected to be examined. Plus, the IRS recently received additional funding in the Inflation Reduction Act to improve customer service, upgrade technology and increase audits of high-income taxpayers. But with proper…

Read MoreShine a light on sales prospects to brighten the days ahead

When it comes to sales, most businesses labor under two major mandates: 1) Keep selling to existing customers, and 2) Find new ones. To accomplish the former, your sales staff probably gets some help from the marketing and customer service departments. Succeeding at the latter may be more difficult. Yet perhaps the most discernible way a sales…

Read MoreHow to handle evidence in a fraud investigation at your business

Every business owner should establish strong policies, procedures and internal controls to prevent fraud. But don’t stop there. Also be prepared to act if indications arise that, despite your best efforts, wrongdoing has taken place at your company. How you handle the evidence obtained could determine whether you’ll be able to prove the charges brought…

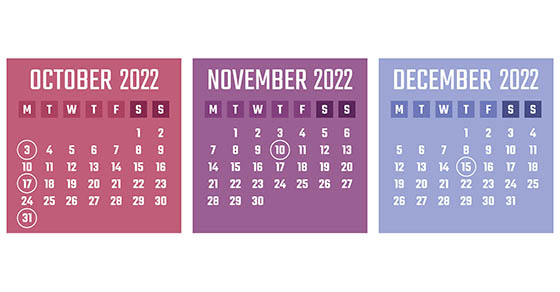

Read More2022 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note:…

Read MoreSometimes businesses need to show customers tough love

“We love our customers!” Many businesses proclaim this at the bottom of their invoices, in their marketing materials and even on the very walls of their physical locations. Obviously, every company needs a solid customer or client base to survive. But, to truly thrive, you need to evaluate which customers are reliably contributing to the…

Read More