Review of Tax Return Letter

Refunds May Be Delayed due to Extra Review

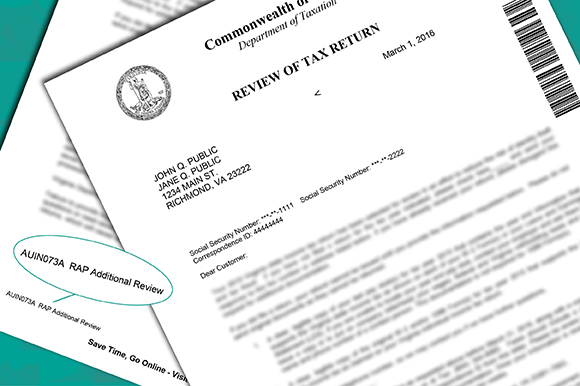

The Virginia Department of Taxation is sending “Review of Tax Return” letters (AUIN073A RAP Additional Review) to some taxpayers to verify withholding information. This letter tells you that the Virginia Department of Taxation received an individual income tax return with your name and/or social security number and needs additional information to verify the amount of withholding claimed on your return.

Why did I receive this letter?

Because of the increase in identity theft and refund fraud, the Department is taking additional precautions to validate the refund returns being processed. Receiving the letter does not mean you are victims of identity theft or that your return contains errors or missing data, just means that your return was stopped for review. In many cases it means the Department may not have all of the necessary withholding information from an employer, retirement fund or other payer to verify that the withholding information on your return is correct, so we need additional documentation from you before processing the return.

How do I know this letter is not a scam to get my personal information?

The Department sends letters requesting withholding and employment documentation throughout the year, and more frequently during filing season. If you’re concerned that the letter you received is a scam:

- Check that “AUIN073A RAP Additional Review” is in the bottom left corner of the letter, and

- Verify that the address and fax number on the letter match the one below:

Virginia Department of Taxation

RAP Unit 1

P.O. Box 27003

Richmond, VA 23261-7003

Fax: (804) 344-8565

What should I do?

If you did not submit a return to the Department, please check the box in the first paragraph and return the letter immediately to the address or fax number printed above. If you did file a return, follow the instructions in the letter and submit all requested documents as soon as possible to the address or fax number above. If you filed a return and already received your refund, or receive one prior to sending us the requested information, we were able to verify your return through other means and no longer need additional documentation from you. You may disregard the letter.

What’s the process?

What’s the process?

If you did not file a return, you may be a victim of identity theft. Once you return the AUIN073A letter indicating that you did not file a return, we will reject the return that was filed using your personal information. If you still need to file a return for the tax year indicated in the AUIN073A letter, you will need to file a paper return. If you think you are a victim of tax-related identity theft, you may want to:

- Contact your local police or sheriff’s department and file a criminal complaint.

- Report your identify theft to the Federal Trade Commission.

- Submit Form 14039 Identity Theft Affidavit to the IRS.

- Call our Identity Theft Information line at (804) 404-4185 to discuss your account.

- You may also want to contact one of the three major credit bureaus (Equifax, Experian and TransUnion) to place a fraud alert on your credit records.

If you did file the return, we will continue processing your return once we receive all requested documents and can confirm that the return is correct. Please allow 7 business days for us to receive your fax or mailed documents. During peak filing season, and as a result of our enhanced security features, your return will take longer for us to process than previous years. If it has been over 8 – 10 weeks since you submitted your documents and you have not received your refund, please contact us.